Blockchain and Tokenisation: The Future of Collateral Management in Cleared Derivatives

R Tamara de Silva

The Futures Industry Association (FIA) released a whitepaper a few days ago on the potential of tokenization in the derivatives markets. FIA's June 2025 report entitled, "Accelerating the Velocity of Collateral: The potential for tokenization in cleared derivatives markets,” argues that cleared derivatives markets are at a turning point in regards to the the adoption of tokenization.

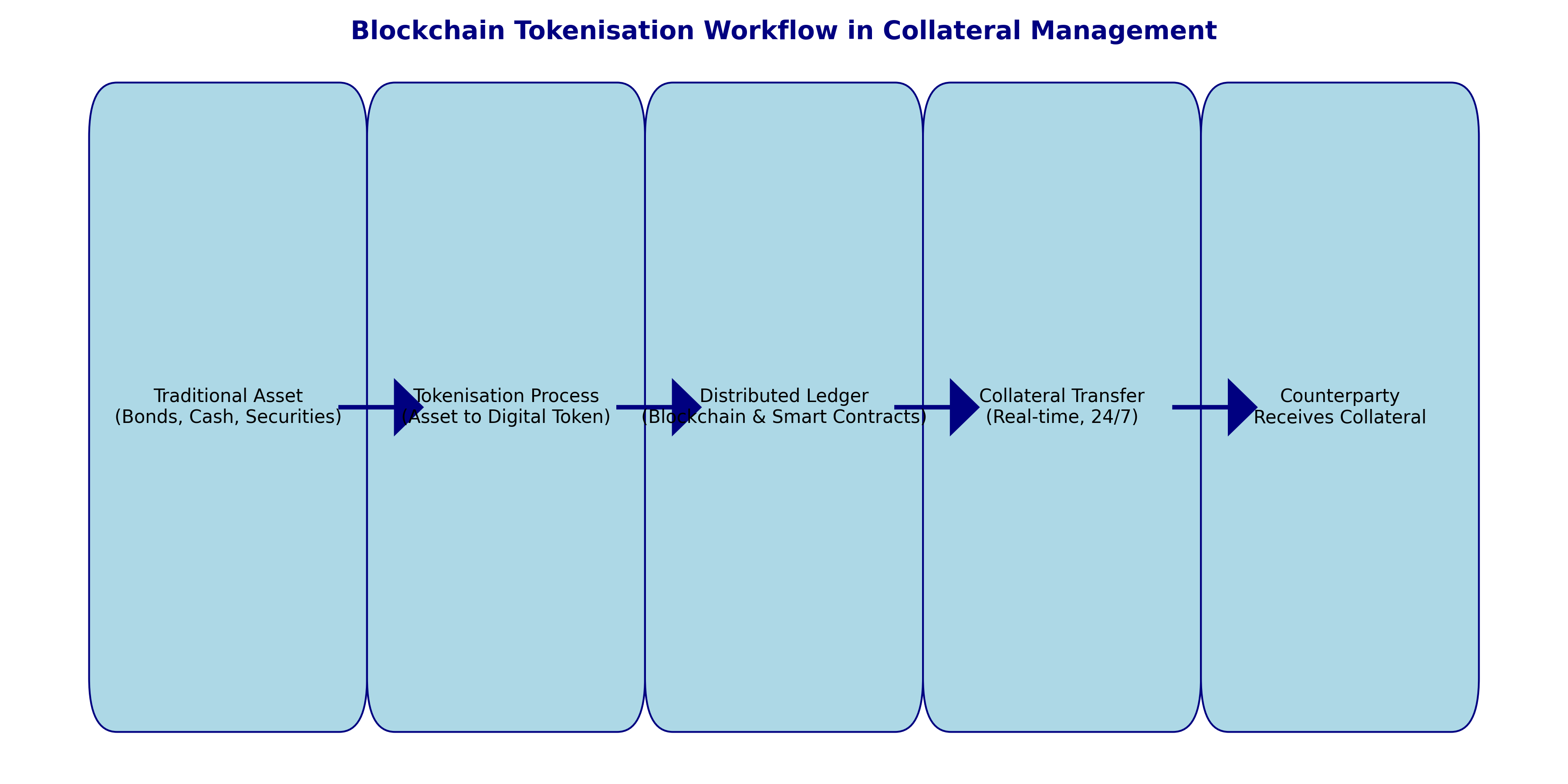

Tokenization leverages blockchain technology to create digital tokens from real world assets. In the context of the futures markets this technology offers meaningful improvements for managing risk in the financial futures markets.

Collateral management is extremely important because every day, market participants daily transfer billions in cash and securities to secure derivatives trades. This collateral acts as a safeguard against volatility and default. The derivatives markets handle enormous sums of money each day, and traditional methods of managing collateral often lag behind today's fast-paced trading environment, leading to inefficiencies, higher costs, and greater risks.

What is Tokenisation?

Tokenization converts real-world assets such as cash, securities, or bonds into digital tokens, which exist and operate on distributed ledger technology, commonly known as blockchain. Blockchain maintains secure, decentralized, and transparent records of transactions across multiple computers, eliminating the need for centralized intermediaries and enhancing transaction efficiency and security. Tokenization can apply to both traditional assets like securities held in custodial systems and native digital assets created directly on blockchain systems.

Blockchain technology has long been discussed as a valuable use case for clearing, settlement, and back-office operations in financial markets. For years, financial institutions and industry experts have explored blockchain’s potential to streamline traditionally complex and slow processes. Early pilot programs and theoretical analyses suggested significant improvements in operational efficiency, transparency, and security. Despite this longstanding interest, widespread practical implementation has lagged due to regulatory, technical, and interoperability challenges. The current wave of innovation, driven by tokenization, presents a renewed and focused opportunity to realize blockchain's extensive potential fully.

Adoption is Accelerating

The FIA report identifies four factors contributing to rapid tokenization adoption in financial markets:

- Widespread Awareness: Major institutions, like JP Morgan and asset managers such as Blackrock, have already started using tokenisation, particularly for repo markets and money market funds. The growth of stablecoins, rising from $135 billion in circulation in January 2024 to $240 billion by April 2025, further exemplifies growing acceptance. This widespread recognition signals how tokenisation is becoming an essential aspect of modern finance.

- Clearinghouse Engagement: Prominent clearinghouses like Eurex, DTCC, CME Group, and ICE are actively exploring blockchain for clearing and collateral management. For example, DTCC highlights blockchain as the "killer app" for collateral mobility, demonstrating real-time blockchain-based collateral management in practical trials. The active engagement of these major infrastructure providers underscores blockchain's critical role in future market operations.

- Crypto Asset Market Model: Crypto markets already use tokenisation extensively for collateral, demonstrating its viability and scale potential. Partnerships between institutions like Standard Chartered and crypto exchanges further showcase this integration. These practical implementations serve as proof-of-concept for traditional finance institutions seeking to adopt blockchain solutions.

- Regulatory Support: Regulators worldwide, including the Bank for International Settlements, Monetary Authority of Singapore, and regulatory bodies in Switzerland, Luxembourg, and the UK, have shown increased support and guidance for tokenization adoption. The U.S. regulatory landscape is also shifting positively post-2024 elections, with more supportive stances from the SEC and CFTC. This regulatory backing is crucial in providing the clarity needed for broad adoption.

Real-World Case Studies

Tokenization of collateral can accelerate asset transfers across a distributed ledger network. Tokenization is no longer theoretical; several major institutions have piloted or implemented it in collateral management and post-trade operations.

In late 2023, J.P. Morgan executed a first-of-its-kind blockchain-based collateral settlement with BlackRock and Barclays, using its Onyx Digital Assets platform. BlackRock tokenized shares of a money market fund and transferred them to Barclays as collateral for an OTC derivatives trade, with the entire process completing in minutes.[i] This near-instant transfer, a task that traditionally takes days, demonstrated how tokenized assets can be moved and settled almost immediately, a breakthrough for margin management under time pressure[ii]. BlackRock noted that posting tokenized fund shares “dramatically reduce[s] the operational friction” of meeting urgent margin calls during market stress, highlighting the real-world payoff of the technology.

Other industry initiatives have followed suit. In Europe, Deutsche Börse’s Eurex Clearing partnered with digital collateral network HQLAx to enable clients to mobilize and pledge non-cash assets via a distributed ledger for margin requirements. And in the US, the Depository Trust & Clearing Corporation (DTCC), the country’s largest clearinghouse, views enhanced collateral mobility as the “killer app” for blockchain. In April 2025, DTCC demonstrated a digital collateral management platform that showed how tokenized assets could be deployed in real time across participants and time zones to meet margin needs. These projects indicate that post-trade infrastructure is evolving to incorporate tokenization at scale.

Tokenization is also gaining traction in broader financial markets closely tied to derivatives. For instance, in the U.S. repo market, several large banks now use Broadridge’s DLT-based platform to execute overnight repo transactions, with volumes averaging about $1.5 trillion per month in 2024.[iii] This adoption underscores the appeal of near-instant collateral settlement in a high-volume funding market. Likewise, asset managers such as BlackRock, Franklin Templeton, and WisdomTree have launched tokenized money market funds, whose combined assets under management reached over $6.9 billion by April 2025[iv].

These tokenized fund shares can be traded or pledged around the clock, and some clearinghouses are beginning to accept them in lieu of cash, marrying innovations in traditional fund management with the needs of cleared derivatives collateral. Each of these case studies, from J.P. Morgan’s blockchain network to DTCC’s prototypes and tokenized funds, illustrates tangible progress in using tokenization to streamline collateral movements in financial markets.

Traditional collateral management is often complicated and inefficient. Moving non-cash assets usually involves many intermediaries and different systems that don't easily work together. Additionally, constraints such as weekend and holiday banking closures and cross-border settlement challenges complicate the timely transfer of collateral. What is more, these challenges significantly increase risk, costs, and operational friction within derivatives markets.

And although cash is easier to post as collateral, is expensive to hold, forcing market participants to maintain liquid reserves in income-generating non-cash assets like government securities. These in turn have to be liquided to generate cash quickly, further complicating and slowing down the entire process.

Comparative Analysis: Traditional vs. Tokenised Collateral Systems

Speed and Settlement Times: Traditional collateral management is hindered by batch processing and cut-off times – moving securities between institutions often takes T+1 or longer, especially across different custodians or time zones. By contrast, tokenized systems can transfer ownership in near real-time, cutting settlement from days to minutes, as discussed in the FIA whitepaper.

In practice, this means meeting a margin call with non-cash assets no longer requires waiting for overnight batch settlements; a tokenized Treasury bond or fund share can be delivered almost immediately once a margin trigger hits. For example, during a 2023 pilot, BlackRock observed that transferring tokenized fund shares to cover a derivatives margin call took only a few minutes, whereas traditional methods would have taken overnight or longer.[v] The improved speed not only meets urgent liquidity demands but also reduces the window of exposure when a counterparty is awaiting collateral.

Operational Complexity and Cost: Legacy collateral processes involve multiple intermediaries (custodians, clearing banks, transfer agents) and siloed ledgers at each institution. Each party maintains its own records, and reconciliation of these records is time-consuming and error-prone.

In some clearing workflows, communications still rely on manual steps (even faxes) and human coordination, causing delays. It can take up to five days to retrieve a piece of collateral from certain clearinghouses under current processes.[vi]

This fragmented system drives up operational costs and often forces market participants to post excess collateral (e.g. keeping large blocks of Treasuries parked at a CCP) because dynamically optimizing across asset types is too slow and uncertain. Tokenized collateral systems fundamentally change this equation. All participants share a single source of truth on a distributed ledger, so asset ownership updates instantly for everyone, eliminating the need to reconcile disparate databases. This streamlining cuts down on manual processing costs and settlement fails.

J.P. Morgan’s early tokenization trials, for instance, found that posting tokens was not only faster but also more cost-effective for meeting margin requirements, by reducing duplicative processes and errors in the workflow.[vii] In short, tokenization replaces labor-intensive coordination with automated execution, yielding lower operational risk and cost per transfer.

Extended Hours and Counterparty Coordination: Traditional collateral movements are constrained by banking hours and settlement windows. For example, if a margin call comes late in the day, a clearing member may have to wait until the next morning (or after a weekend) to move securities, leaving firms exposed overnight. Tokenized systems decouple collateral transfers from these limitations by enabling 24/7 settlement on blockchain networks.

In a tokenized model, counterparties can coordinate and fulfill margin obligations at any time, without needing synchronization of wire systems or central depositories’ hours. This around-the-clock capability leads to smoother coordination between trading partners. It also minimizes the need for emergency measures like after-hours credit lines, since participants can rapidly mobilize eligible assets on their own. The difference in settlement flexibility is stark: under the traditional regime, markets effectively “pause” when banks close, whereas a tokenized collateral network remains continuously available, allowing firms to respond immediately to global events or late-day price swings. The result is faster dispute resolution, fewer bottlenecks in moving collateral across borders, and much tighter alignment between trading activity and the post-trade collateral flows that support it.

Benefits of Tokenization

Blockchain technology transforms collateral management, enabling near-instant transfers and slashing settlement times from days to mere minutes. Markets become more liquid and responsive. Unlike traditional banking systems constrained by limited hours, blockchain facilitates continuous, 24/7 collateral movement without interruption. A shared ledger ensures accuracy, transparency, and consistency, eliminating discrepancies and errors common to fragmented, multi-ledger systems. Smart contracts automate critical tasks such as interest payments and margin call settlements. By removing manual intervention, smart contracts greatly reduce administrative overhead and operational errors. The result is a streamlined, efficient collateral management process.

From a Risk Management Perspective

Tokenization offers significant improvements in both operational and systemic risk management for cleared derivatives markets.

Under current systems, a sharp market move on a Friday night or holiday can leave clearing members unable to post additional collateral until banks reopen, creating a liquidity gap. With tokenized collateral, however, a firm facing a sudden margin call can transfer assets immediately at any time, eliminating the overnight exposure that would otherwise exist. Continuous, around-the-clock settlement capability thus acts as a safety valve, reducing the likelihood that time delays turn into credit crises. Even on weekends or holidays, a tokenized system could promptly top-up margins and prevent small shortfalls from snowballing into larger problems.

Real-time settlement also slashes counterparty credit risk by shrinking the duration that parties are waiting for collateral to arrive. A recent example highlights this benefit: during the 2022 UK gilt crisis, pension funds needed to post huge margins on short notice and had to sell money market fund holdings, which then took days to settle, for those interim days, the funds and their counterparties were exposed to default risk while waiting for cash to move.[viii] By compressing settlement timeframes to near-zero, tokenization ensures that collateral is in the right place at the right time, especially during crisis scenarios, thereby bolstering market stability.

From an operational risk standpoint, tokenization reduces errors and enhances transparency. In collateral management, inconsistent records and manual processing can lead to misbooked trades or disputes over collateral balances. Using a distributed ledger as a single shared record means that every party from clearing brokers, CCPs, to clients, sees the same, up-to-date ownership status of assets at all times[ix].

This real-time asset tracking may sharply lower the chance of discrepancies or the notorious “lost collateral” problem where assets are tied up due to paperwork mistakes. Moreover, the technology enables granular, automated control through smart contracts.

Using smart contracts, critical risk-management actions can be programmed into the tokens themselves. For example, a smart contract might automatically trigger a top-up transfer or haircut adjustment if the value of posted collateral falls below a threshold, or release excess collateral back to the pledgor when a position is de-risked[x]. Such self-executing collateral agreements ensure that margin shortfalls are corrected without delay or human error, and they can even integrate compliance checks or reporting.

Tokenization can also improve systemic oversight and resilience. Because transactions on a permissioned blockchain are visible (to authorized nodes) in real time, regulators or auditors can be granted observer access to monitor the flow of collateral as it happens. This transparency makes it easier to spot emerging risks such as a build-up of concentrated exposures or delays. Regulators and SROs can respond before these risks escalate.

By making the movement of non-cash assets as seamless as cash, tokenization expands the usable collateral pool and reduces fire-sale dynamics. Participants no longer need to liquidate assets hastily for cash; they can post high-quality assets directly, which avoids downward price spirals in stressed markets.[xi] Overall, these innovations mean fewer points of failure in the collateral chain. Industry leaders and regulators increasingly view tokenized collateral as a tool to strengthen market plumbing: it injects speed, certainty, and transparency into collateral exchanges, thereby lowering the probability that operational bottlenecks or timing mismatches contribute to a wider financial crisis.

The bottom line is that tokenization, when properly implemented, can enhance both day-to-day risk management (through timely, accurate collateral delivery) and the systemic robustness of financial markets.

Challenges to Adoption Several hurdles remain

With all the advantages discussed above, there are still challenges for mass adoption. For tokenization to succeed, it must match the high standards of existing systems in reliability, security, and speed.

Achieving interoperability across fragmented blockchain ecosystems is critical, and will require clear, universal standards for seamless asset transfers. Institutions also need effective custody models to safeguard sensitive information and address privacy concerns. There will have to be clear regulatory frameworks around tokenized asset legality, settlement finality, and enforceability during insolvency are essential. Additionally, institutions require explicit guidelines for prudent capital treatment and robust cybersecurity practices to defend blockchain systems against cyber threats.

The FIA strongly advocates embracing tokenization due to its clear potential for modernizing and streamlining collateral management in derivatives markets, provided the industry addresses regulatory, technical, and security concerns proactively.

Tokenization represents substantial opportunities for modernizing collateral management within the cleared derivatives markets. Tokenization offers transformative benefits, including faster asset transfers, lower operational risks, increased liquidity, and greater process automation.

To stay ahead in this market landscape, institutional investors, clearinghouses, and financial market participants would be well advised to keep abreast and explore the opportunities presented by tokenization.

Contact us today to discuss how your organization can leverage blockchain technology to streamline collateral management, reduce risk, and enhance operational efficiency. This represents one of the most innovative and exciting areas in which we practice.

Endnotes:

[i] https://www.marketsmedia.com/blackrock-barclays-go-live-on-j-p-morgans-tokenized-collateral-network/#:~:text=Tokenization%20occurred%20within%20a%20matter,lateral%20derivatives%20counterparts

[ii] https://www.fia.org/marketvoice/articles/analysis-enthusiasm-builds-tokenisation-collateral-management#:~:text=Sasikumar%20was%20referring%20to%20a,for%20a%20bilateral%20derivatives%20trade

[iii] https://www.fia.org/sites/default/files/2025-06/FIA%20-%20Tokenisation%20-%20Accelerating%20the%20velocity%20of%20collateral.pdf

[iv] Id.

[v] https://www.fia.org/marketvoice/articles/analysis-enthusiasm-builds-tokenisation-collateral-management#:~:text=Sasikumar%20was%20referring%20to%20a,for%20a%20bilateral%20derivatives%20trade

[vi] Id.

[vii] https://www.marketsmedia.com/blackrock-barclays-go-live-on-j-p-morgans-tokenized-collateral-network/#:~:text=Tyrone%20Lobban%2C%20Head%20of%20Onyx,%E2%80%9D

[viii] https://www.nasdaq.com/solutions/fintech/nasdaq-calypso/collateral-margin-securities-finance?_bt=732749714127&_bk=collateral%20mgmt&_bm=p&_bn=g&_bg=175710118227&utm_term=collateral%20mgmt&utm_campaign=&utm_source=google&utm_medium=ppc&gad_source=1&gad_campaignid=22069126480&gbraid=0AAAAAoJZd6IMILwrYsKrSpTElH6Pp2Esf&gclid=CjwKCAjw9uPCBhATEiwABHN9Kyg0lQjRO_o8MrJ2uV1G7-8hDRXdOu5GXD30LItYHxKe0aC9si87fxoCSfkQAvD_BwE

[ix] https://www.fia.org/marketvoice/articles/analysis-enthusiasm-builds-tokenisation-collateral-management#:~:text=A%20second%20benefit%20is%20operational,ledger%20that%20underpins%20the%20transactions